I mention this to make clear funds from that “finders fee” paid by Wau Holland to Gabriel were moved to be converted into something else (to a crypto exchange) long after Julian was freed. I dont doubt Australia’s crypto regulation or regulatory oversight.

I wanted to understand that the conversion itself was not irregular, as in illegal. So I researched the information. I assumed it would be difficult for some here to research Australian Government websites.

But questions remain for Gabriel to answer why it has been done that way and whether such aligns with Wau Holland’s mission.

All of the issues you raised after Julian was released are relevant. I don’t understand why Gabriel can’t say the funds are for xxxxxx. Presumably they’re for Assange’s Pardon. If they are, then does the DAO need to do more in that respect when it has more than enough projects to give priority to?

This is why the answers/transparency are relevant I think. People need facts to make informed decisions about its priorities.

This sort of thing does make me think twice about devoting any time, energy and money to “campaigns”.

According to the program, next week will be the time to vote on the two multi-signature candidates. Have the GTC members discussed it yet? The community is looking forward to it.

@SilkeNoa three years ago, when DAOs were an emerging phenomenon with virtually no legal or regulatory framework, did you believe that having three multi-signature participants from the same region posed legal risks based on assumption, or were there specific legal provisions targeting multi-signature mechanisms? please provide the specific jurisdictional legal provisions that existed at the time regarding restrictions on multi-signature participants from the same region.

In today’s more welcoming cryptographic environment, what additional targeted legal provisions have been introduced concerning multi-signature arrangements?

If there’s no better plan, I agree with zylo’s suggestion to include Gabriel.I agree to shortlist all 5/5 nominees including Gabriel.now we can hold a vote on snapshot now, and we can discuss the subsequent matters after the governance is implemented.

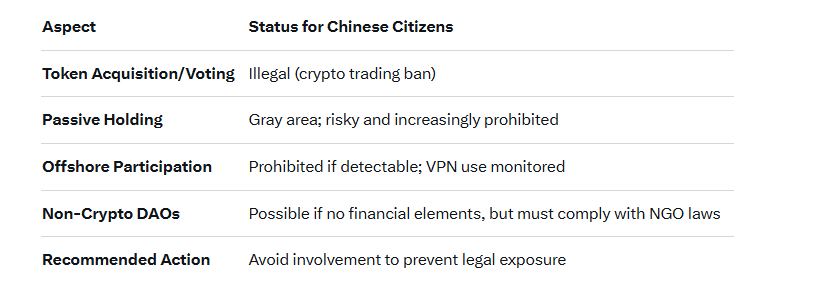

Sudongpo - what about the risk if participants are based in China and are a Chinese citizen? And if there was a sudden crack down on citizens involved in foreign DAOs?

Hong Kong and Macau citizens are permitted to be involved in DAOs - but not mainland Chinese??? So I’ve researched.

By law, Chinese mainland citizens are regulated:

Virtual currency (including DAO tokens) is not recognised as legal tender and is deemed illegal for financial use. Jan 2021 - Notice on Preventing Risks from Virtual Currency Trading (China)

Announcement on Preventing Financial Risks from Token Issuance (“ICO Ban”) 2017 (China) - “Tokens are treated as illegal fundraising tools.”

Prohibited Activities by Chinese citizens : Joining a DAO typically requires acquiring governance tokens (e.g., via purchase or airdrop), which violates the 2017 ICO ban and 2021 trading prohibitions. Voting or contributing to DAO decisions using these tokens constitutes “virtual currency-related business activities,” explicitly banned under the 2021 notices.

Even passive holding or participation in decentralized finance (DeFi) DAOs is illegal if it involves token-based incentives. I presume this is a gray area - as if the Chinese Government - for now - is turning a blind eye to it. But that doesn’t mean they may not be monitoring it.

Presumably that means a Chinese mainland citizen should not be a multisig or hold Justice tokens as that would be in violation of their own country’s legal system. Is there an understanding re the ban to cross border jursidictions?

In summary

So I presume it is a neccesity to avoid too much concentration - in case there was a crackdown - that could end up affecting the DAOs operations. I don’t think it is regional - I think its country based - as in no American citizens should be involved in decision making either at the time (we know that E lied about this by claiming to be an Australian).

no,no,no.First, there is no law that stipulates that individuals purchasing and holding cryptocurrencies is illegal.

Second, administrative regulations impose strict restrictions on financial institutions participating in related businesses, but do not specify limits on individual participation; they only express the obligation to remind of possible investment risks.

Lawyers’ advice should be based on clear legal provisions and objective facts, rather than imagination and speculation.

Why were these not obstacles when raising funds? Did it express a refusal of funds from people in these regions? Why are they obstacles now?

There was no nationality restriction when raising funds, and it was even open to US citizens, so is the current nationality restriction reasonable?

Isn’t this double standards? Is this still fair? Does it conform to the principles of freedom and justice?

I haven’t seen other projects with such restrictions; this should be the first project in the crypto circle to explicitly express racial discrimination tendencies. many people take it for granted instead of providing institutional solutions; this is a regression of civilization.

OK. I agree some of these announcements could be fake news to affect markets - as in the 2025 one which Forbes has disputed. The VPN and 2021 ones stand though. I honestly think Silke’s intention is about reducing risk. Its not personal.

Many problems are based on imagination rather than facts, always assuming the worst possible outcome and believing that any cooperation or attempt is doomed to fail. The absurdity of excessive worry - in the absence of actual support, purely fictional anxiety scenarios not only deviate from reality but also hinder rational decision-making.

Another obvious example is 35’s frequent expression of anxiety about $justice being overlyhyped.However,the fact is that $justice’s low liquidity over the past three years indicates that the market does not view it as a speculative target.like a penniless homeless person worrying about how to spend millions after becoming a billionaire.

This non-fact-based thinking distorts people’s cognition, focusing attention on non-existent risks. Only when community members can distinguish between facts and speculation, and build a discussion framework based on reliable information, can they avoid decision-making errors caused by cognitive biases. In DAO governance, it is particularly important to be vigilant against replacing factual verification with subjective speculation. This not only helps implement current governance but also lays a rational foundation for DAO’s long-term governance.

People must submit to reason.

The only thing we have to fear is fear itself.

Prejudice is the enemy of knowledge,

Decisions must remain grounded in facts.

Dear GTU members, this week should have been the time for voting. The community is anxiously awaiting the outcome of our discussions. Please proceed according to the agreed-upon rules and do not pause. Where is the consensus currently being reached? If GTU members cannot reach a decision, please let the community vote.

In my view, if three multi-signs appear in any jurisdiction or organization, then the DAO is under the actual control by those entities.

DAOs require decentralized governance! Any rational thinker should take these risks seriously!

Okay, I agree with Zylo’s proposal. the associated risks are manageable, and having Gabriel participate in the election is feasible. we should reach a consensus and move forward with the governance process.